Plan Your Retirement Savings Goals for 2022

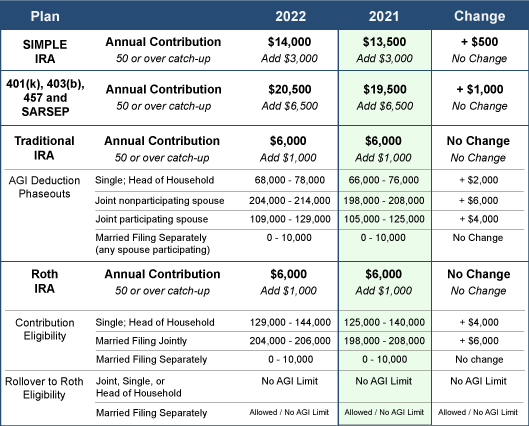

There's good news for your retirement accounts in 2022! The IRS recently announced that you can contribute more pre-tax money to several retirement plans in 2022. Take a look at the following contribution limits for several of the more popular retirement plans:

What You Can Do

Look for your retirement savings plan from the table and note the annual savings limit of the plan. If you are 50 years or older, add the catch-up amount to your potential savings total.

Then make adjustments to your employer provided retirement savings plan as soon as possible in 2022 to adjust your contribution amount.

Double check to ensure you are taking full advantage of any employee matching contributions into your account.

Use this time to review and re-balance your investment choices as appropriate for your situation.

Set up new accounts for a spouse and/or dependents. Enable them to take advantage of the higher limits, too.

Consider IRAs. Many employees maintain employer-provided plans without realizing they could also establish a traditional or Roth IRA. Use this time to review your situation and see if these additional accounts might benefit you or someone else in your family.

Review contributions to other tax-advantaged plans, including flexible spending accounts (FSAs) and health savings accounts (HSAs).

Now is a great time to make 2022 a year to remember for retirement savings!

Share Us On: